Jet Fuel A1

QEYTARAN TRADING LLC

Ref: Max – Alex

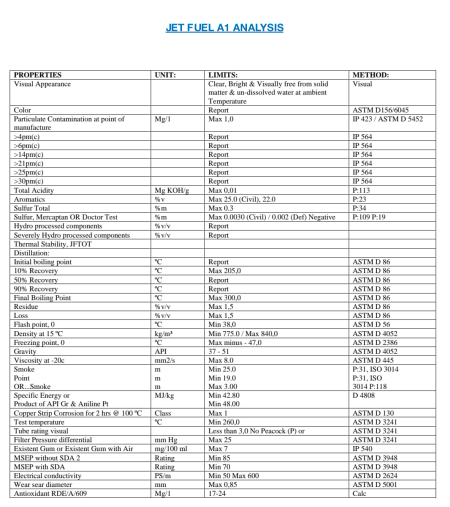

Jet Fuel A1

Origin: Non- Sanction Countries

Quantity: Minimum: 1,000,000 Barrels per Month / Maximum: 5,000,000 Barrels per Month

Price: Gross Minus 7% – 10% USD per Metric Ton NWE Platt

Delivery Procedure – CIF

1. Buyer requests the product via Request For Quotation (RFQ), with a complete KYC form including; trading license attached, bank details, instrument’s issuing bank details, destination port, terminal, product type, quantity, and specifications.

2. We issue a Term Sheet, upon acceptance of the Buyer, We issue a Sale and Purchase Agreement (SPA) to the Buyer.

3. Buyer inserts their SBLC Sending Banker Coordinates and returns to us in < 2 banking days.

4. We return SPA Contract with receiving banker coordinates in < 48 hours.

5. Buyer and we register the signed contract with their banker within forty-eight (48) hours.

6. Buyer’s bank transmits MT 799 pre-advice, and our bank transmits an MT 799 answer back to confirm.

7. Buyer’s bank transmits a non-transferable Standby Letter of Credit (SBLC) equal to or greater than $xxx,000,000.00 valid for twelve (12) months in less than 5 banking days to the indicated bank account We issue a Performance Bond for 2% of the instrument’s value in return.

8. Upon validation of the SBLC, we place the order with the refinery and set a position for delivery schedule with the Manufacturer and Vessel Charter Company.

9. We, upon loading the initial vessel provide product load documents, including but not limited to:

– Charter Party Agreement,

– Vessel Master contact details Q88,

– Vessel load injection report by SGS (product assay),

– Product Export license,

– Vessel Manifest,

– Ullage report,

– Certificate of origin,

– Master receipt & Customs clearance from the loading port,

– Copy of the declaration of availability of the products,

– Copy of the refinery Commitment to supply,

– Certificate of ownership,

– Allocation Transaction Passport Code (ATPC) Certificate.

– Relevant documents will be issued with Contract Code xxxxxxxxxxxxxxxxxx

10. Vessel sails for destination port identified by Buyer as: xxxxxxxxxxxxxxxxxxx

11. Vessel arrives at the Buyer’s destination, the Vessel Master/Charter Company obtains customs inspection clearance and provides details to the Buyer.

12. Buyer performs a third-party inspection at their expense / we provide a recent inspection report (not older than 48 hours).

13. Vessel moves into a berth for off-loading

14. Buyer makes vessel delivery payment in US Dollars via SWIFT MT103 bank wire less than three (3) days from Buyer’s Inspection per our Invoice.

15. We provide the title certificate and the Buyer takes possession.

16. Deliveries continue per contract.

Trading Procedure instruction:

Here below, please find our SOP for further action.

Protocols we currently use to deliver petroleum products:

Buyer sends an RFQ (LOI) on their Letterhead (aka; RFQ, CPO, etc), Along with a complete KYC (CIS) form via official Email. We load from the nearest port to deliver at the lowest possible price.

Proof of Funds (POF) is needed as we are the TITLE HOLDER of the products we deliver. We need confirmation the buyer can:

* Issue a Collateral Instrument from an acceptable bank

* Send payment via MT103 [bank wire] AFTER we deliver

POF Option One: Documents/data must be < 60 days old:

Bank Statement, Bank Capacity Letter (BCL), Banker Signed Tear Sheet, Banker to Client Email, Banker to our office Email.

A ‘banker signed’ Ready Willing and Able (RWA) letter to issue a Bank Collateral Instrument for the buyer or other acceptable document.

The buyer can send their POF documents to: One of our offices, one of our attorneys, or one of our bankers.

POF Option Two: the buyer sends our office an Authorization to Verify (ATV) document. (We can provide an ATV template)

Our attorney will validate the buyer’s financial capacity.

A Buyer can use a third-party financier to send the POF or Bank RWA.

When the POF (or RWA Letter) is verified, We issue a [written] Term Sheet to the BUYER.

Our prices are WELL BELOW PLATTS. Term Sheets are NOT given to 3rd parties.

When the term sheet is accepted, we issue the Sale Purchase Agreement. (SPA) to the BUYER

This SPA has a price, index discount, volume, load/discharge ports, timeline, product specifications, and other tacit data.

Our signature will be on many of these documents

The Buyer can validate ALL documents to their creator(s).

The buyer can track or communicate with the vessel at their convenience. Our Vessel Captain contacts us and the target harbourmaster PRIOR to arrival. Customs will accompany our representative [and buyer] per local rules. Certificate of Title Transfer is issued when payment is made AFTER inspection. Shore tanks are injected in the harbourmaster direction (or other buyers’ option) Our Signature will Pass Title

Payment is made AFTER INSPECTION at the target port (or vessel) We deliver at OUR expense and there are NO UPFRONT FEES. SBLC Alternative – Escrow

We work with a regulated statutory trust, licensed both in the U.S. and Israel – https://www.rmg-capital.com/ RMG Capital Escrow Service, a part of RMG Capital Group, is intricately designed to provide a comprehensive suite of financial and escrow services. Licensed and insured under the stringent guidelines of the Delaware Statutory Trust Act (DSTA) and regulated by the U.S. Securities and Exchange Commission (SEC), RMG Capital Group commits to high standards of governance that align with regulatory expectations and evolving best practices. This dedication to governance ensures the interests of clients and investors are meticulously safeguarded, with a focus on transparency, accountability, and ethical conduct.

As a Delaware Statutory Trust (DST) and Investment Company based in New York, USA, and Tel Aviv, Israel, RMG operates at the intersection of private regulation and international compliance. Their escrow and paymaster services, in particular, are central to their operations, providing secure fund transfers and depository services. They act as an independent third party, holding funds in trust and releasing them based on predetermined conditions, ensuring a secure, efficient, and transparent transaction process. This system of transaction monitoring, recordkeeping, and reporting fosters enhanced security, reducing the risk of fraud and unauthorized access, while also ensuring efficiency and compliance with regulatory requirements.

What sets RMG Capital Group apart is not just their compliance with corporate governance principles but also their innovative approach to asset and investment management. They offer tailored investment solutions that reflect the individual needs and goals of their clients, supported by a flexible technology platform and a commitment to complete transparency. The firm’s services include a broad spectrum from credit enhancement assets and programs to complex financing solutions, emphasizing their capability to facilitate large and complex projects on a worldwide basis.

In essence, RMG Capital Escrow Service secures its clients’ escrow funds and financial instruments through a blend of stringent regulatory adherence, comprehensive risk management practices, and innovative financial solutions. This ensures not only the safety of clients’ funds but also the potential for growth and prosperity through wellstructured financial instruments